This means insurer submit their "cost list" of all the policies they sell with the state's insurance department. This regulation implies an agent selling you an insurance plan can't estimate a higher cost than if you 'd just gone straight to the company itself. That's why it's wise to get a variety of quotes from an agent.

Insurance representatives fall into two types captive or independent. The distinction between the 2 is how far they can reach into the life insurance marketplace. Captive insurance representatives are only able to sell insurance on behalf of the company they work for. They have great understanding of the policies offered however are limited since of being captive to that company alone.

That suggests noncaptive representatives can find and sell insurance coverage from a much larger pool of life insurance coverage providers. Which benefits you due to the fact that they can save you money on your premium (which is the amount you pay regular monthly or annually for your life insurance coverage.) So, you have actually made the call and are speaking with a representative.

Are they listening well about who you are and what you need coverage for? Make certain they're not trying to oversell things to you. Life insurance coverage is complicated enough without them dodging your questionsno matter how minor they seem. If they're pushing you to decide on that very first call, it's too soon! They should not keep this details, in addition to how much commission they're paid, either.

You can be prepared by knowing what they indicate, but if they're still attempting to offer you a lot of stuff you do not need (or are simply a bad listener), they're not doing their job! It's constantly a good idea to utilize an expert when it concerns purchasing life insurance.

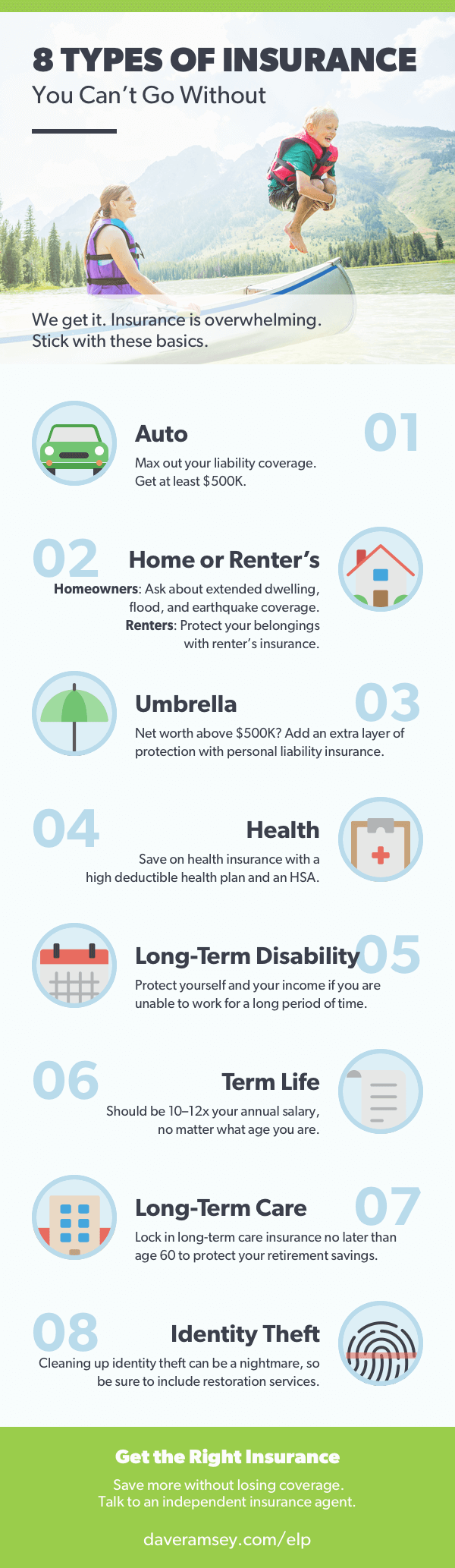

It fasts and simple to utilize and gives you something to deal with when you're speaking with a representative. Dave constantly advises choosing independent insurance agents. They can search a bigger market to get the best option for you, saving you time and cash. Our relied on good friends at Zander Insurance have been assisting people much like you get the very best life insurance coverage prepare for decades.

By Ashley Donohoe Updated June 28, 2018 Independent insurance coverage agents run their own businesses and they can pick which insurance brokerages they want to work with. These agents use their knowledge to help their clients discover the insurance coverage policies that fit their needs and spending plans. This holds true whether the agent's customers require health, vehicle, home, life insurance or any other kind of insurance coverage.

How What Do You Need To Be A Insurance Agent can Save You Time, Stress, and Money.

You'll have greater versatility in choosing your own insurance coverage items. Just how much independent insurance agents make differs by how lots of clients they have; what kinds of customers and how many insurance items their clients buy; and what the commission structure is like for the brokerages they deal with. Independent insurance coverage representatives are considered company owners who can provide insurance items from a variety of providers to their customers.

They offer customers with client service, including providing info about specific policies, aiding with the policy choice procedure, getting customers registered for insurance coverage and helping them restore their policies as needed. When working with clients, be confident and convincing so that you motivate your customers to purchase what you're using.

You can begin working as an independent insurance coverage representative with a high school diploma; however, making a degree associated with business can offer you with useful service and sales skills. You also need to become certified in your state for you to be able to sell the kinds of insurance products you want; frequently, this needs taking insurance courses and passing exams.

After you're https://www.businesswire.com/news/home/20200115005652/en/Wesley-Financial-Group-Founder-Issues-New-Year%E2%80%99s licensed, insured and registered, you can begin contracting with insurance brokerages to use products to your customers (how much does a state farm insurance agent make). The mean yearly wage for all insurance coverage representatives in May 2017 was; wages were less for the lower half of representatives and higher for the top half, reported the Bureau of Labor Statistics.

Insurance coverage carriers offered a typical wage of, whereas insurance agencies and brokerages used a somewhat lower typical wage of. Utilizing over half of insurance agents, insurance coverage agencies and brokerages are the top employers. Roughly 18 percent of insurance representatives are self-employed, whereas a smaller number of agents work for insurance providers.

A great deal of your time will be invested calling how to write letter to give back time share clients by means of phone or internet in a workplace or taking a trip to meet them face to face. This position usually needs that you work full-time at this endeavor; you might also discover that you need to work extra hours to deal with documentation and marketing.

When you first begin, you'll require to build a client base to earn a constant income, which usually comes from your commission from the products you have actually offered. Throughout the years, as you develop your client base, get experience, and market yourself, you can anticipate to make more cash. PayScale reported that an independent insurance agent's income ranged from $24,658 to $62,629 (consisting of rewards and commissions) in April 2018.

The Best Guide To How To Be A Life Insurance Agent

Independent insurance agents have great task potential customers, https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 since it is more cost effective for insurance provider to deal with them. Although clients tend to look for insurance coverage alternatives online, independent agents are required to assist customers pick the best choices and to use details about policies. To maximize your potential customers, you can sell medical insurance coverage, which remains in high demand.

It's no surprise that selling life insurance is such a popular profession. With over 1 million insurance coverage representatives, brokers, and service staff members in the united states in 2020, it remains one of the largest industries. Among the benefits of selling life insurance are the flexible hours. You can do it on the side in the beginning and make a great living if you want to put in the work.

It involves making telephone call, setting appointments, following up, and getting informed NO. If this does not sound like nails on a chalkboard to you, then chances are you have the ideal character for offering life insurance coverage. Like any profession, it takes time to acquire experience and develop your earnings.

Many make a lot more than that! You can expect to earn $2,000-5,000 each month starting. This will depend on the products you sell, the commissions, and how hard you are ready to work. Many agents these days choose to offer items from the finest life insurance companies. See this page to learn more about no examination life insurance.

Lots of representatives start in insurance coverage as a "side hustle". They typically invest time at nights networking to make sales. When you get a license and agreement, start reaching out. Buddies, close family members, and members of their neighborhood are a great way to get sales. Quickly you will see the chance for what it is and may select to dedicate to selling insurance coverage full-time.

I suggest ExamFX, and their self-study course is $149. 95 in the state of Georgia. You will have 60 days to finish the course and pass the simulated exam. When completed, you will receive your certificate. To take the state exam, you will need the certificate. The state exam in Georgia is $63.